The Financial Huddle

The Financial Huddle

The Financial Huddle

Financial Education & Literacy Opportunities for All Ages

The Financial Huddle is a partnership between Zeal Credit Union and businessman, philanthropist, and 11-season Detroit Lions alum, Herman Moore.

This partnership was created to provide Zeal members and the community with access to engaging financial education in a variety of forms, including:

- Webinars

- Podcasts

- In-Person Seminars

- Interactive “Reality Sessions”

- Community and Nonprofit Partnerships

- …and other Special Events!

Join us for any – or all – of the events listed and learn how to tackle everything life has to offer with poise, purpose, and passion.

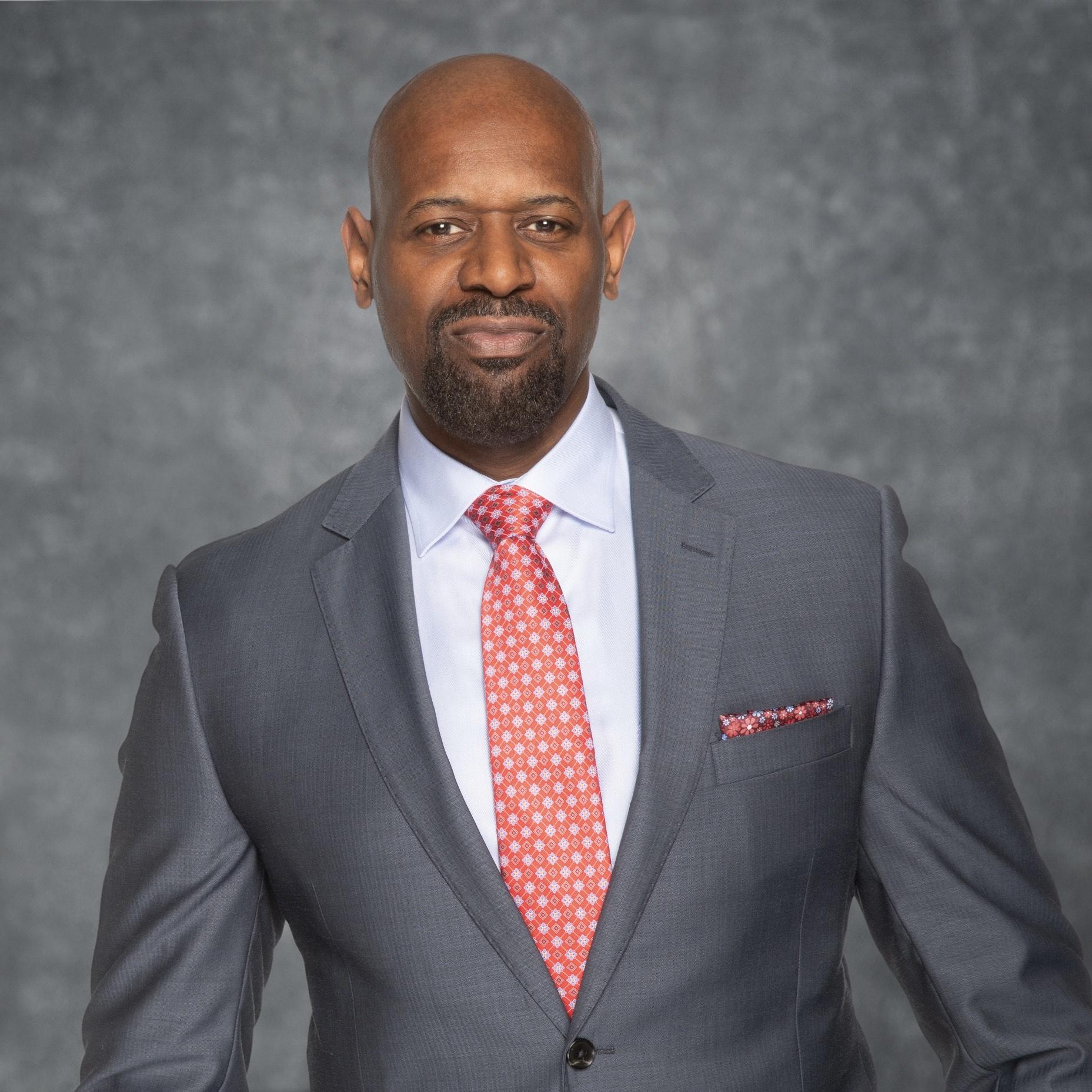

About Herman Moore

Herman Moore is the Founder & CEO of Team 84, LLC, a certified Minority Business holding company spanning manufacturing, marketing, branding, e-commerce, and business intelligence. Through The Herman Moore Tackle Life Foundation, he provides mental health support, life skills training, and mentorship to help individuals and organizations thrive.

Before his business career, Moore was a four-time NFL Pro Bowl wide receiver for the Detroit Lions and one of the league’s most productive players. A member of the Michigan and Virginia Sports Halls of Fame, he continues to drive impact in business and community development.

The Financial Huddle In-Person Events & Seminars

Look below to see our upcoming events and seminars. Simply click on the event name to RSVP today!

Upcoming In-Person/Seminar Events:

- Investing in a Volatile Market (Seminar) – Tuesday, April 29, 2025 (5:30pm – 7pm EST)

- Hosted at Zeal’s Corporate Headquarters at 17250 Newburgh Rd, Livonia, MI 48152

More Events Coming Soon!

The Financial Huddle Webinars

Missed a community event or financial webinar? No worries – we’ve got a playlist for that. Visit our YouTube page and rewatch previous webinars and community event videos whenever you have time.

Upcoming Webinar Topics:

- Financial Literacy Building Blocks: From Savings to Loans and More

- Understanding Credit Reports and Scores (Webinar) – Wednesday, April 23, 2025 (12pm – 1pm EST)

- All You Need to Know About Mortgages (Webinar) – Wednesday, April 30, 2025 (5pm – 7pm EST)

More Webinars Coming Soon!

The Financial Huddle Podcast

The Financial Huddle podcast featuring Herman Moore is the perfect way to tackle financial literacy topics in easy-to-understand, bite-sized pieces. All podcasts are available through YouTube and can be accessed on-the-go so you can enjoy them wherever life takes you.

Upcoming Podcast Topics Include:

- Building, Repairing, and Maximizing Your Credit Score

- Tips to Understand Lending and How to Find the Best Loan For Your Situation

- Starting and Growing Your Retirement Funds

- …and much more!

Podcasts Coming Soon!

Looking for Even More Resources?

DUAL CAREGIVERS – FINANCIAL STRATEGIES

“More individuals are juggling the responsibilities of caring for both aging parents and their own children. Extra expenses coupled with reduced work hours can lead to long-term implications for the financial stability of caregivers.”

The number of family caregivers supporting older adults increased by nearly one-third between 2011 and 2022. By 2034, adults age 65 and older will outnumber children under the age of 18 for the first time, according to AARP’s Valuing the Invaluable report series.

“Family caregivers are the backbone of long-term care in this country,” said Susan Reinhard, senior vice president of the AARP Public Policy Institute. “The care they provide is invaluable to those receiving it. But this is not just a family issue: it impacts communities, employers, and our health and long-term care systems.”

In GreenPath’s newest article, Financial Strategies for Dual Caregivers, they share tips on how to navigate the challenges caregivers face when caring for both their children and aging parents. Read now in your browser or download the article by selecting the “Download” button to the left.

NAVIGATING JOB LOSS – FINANCIAL STRATEGIES

“Prioritize self-care and give yourself time to process this challenging transition. Once you’ve given yourself time to process [the job loss], make a plan to help ensure your short-term financial stability. Unsure where to turn for financial guidance? Free counseling can help you navigate your financial situation.”

As of February 2025, approximately 7.1 million Americans are unemployed, with the unemployment rate inching up to 4.1%. Amid the recent blanket governmental layoffs, many Americans are facing job loss from their careers that is both unexpected and financially detrimental.

If you or a loved one are facing the turbulent landscape of job loss, review the workbook for a case study, impact discussion points, and a list of support options and helpful resources to get you and your family back on your feet.

In GreenPath’s recently-updated workbook, Navigating Financial Uncertainty: Conversations & Strategies for Stability, you can learn strategies to encourage conversation about personal and financial needs during times of job loss.

30 DAYS TO A BETTER BUDGET – CHALLENGES

“Even when money is tight, small steps can help you regain a sense of control. This challenge is about working with what you have and making a plan that fits your reality.”

April is Financial Capability Month, making it the perfect time to put fresh eyes on your finances. Ever checked your account balance and thought, Where did all my money go? You’re not alone. A well-structured budget doesn’t have to be about cutting back – it’s about gaining control, reducing stress, and working toward what matters, whether that’s paying down debt, saving for retirement, or (finally) taking a vacation.

With GreenPath’s Financial Challenge, 30 Days to a Better Budget, you can create a budget that makes sense for you. Work with what you have and make a plan that fits your reality!

For even more financial resources by Zeal Credit Union and our educational partners, visit our Learning & Education webpage. Here, you’ll find blog articles, newsletters, printable activities, and online money-based games that are fun for the whole family!

For upcoming webinars by our financial partners (such as GreenPath and CUNA Mutual Group), visit our News & Events page.